If you invest in mutual funds or ETFs,

Rita℠ Can Help You Make More Money!

With Rita℠ you can quickly see how much more money you could have made by being in better performing mutual funds and ETFs.

Spoiler alert: You'll likely be shocked!

Until now investors have never been able to answer this key question:

“Of all available choices, which ones are best for me?”

Rita℠ enables you to quickly and easily answer that question in a way no other available tool can.

You’ll wonder why it’s not been available until now.

Spoiler alert: Do you think Wall Street really wants you to have that information?

See just how good your mutual funds are

compared to others

Now, for the first time, see how yours compare - not just to an

index but to every other fund or ETF you could have chosen.

Spoiler alert: Again, you'll likely be shocked!

With Rita℠ you can score and rank hundreds of mutual funds in moments

With Rita℠ you can quickly see if there are much better mutual funds & ETF choices than yours. Spoiler alert: There likely are!

See how good the funds brokers, advisors, and others are recommending actually are.

With Rita℠ not only can you quickly see that, you’ll also be better protected from being talked into buying inferior mutual funds and ETFs. Spoiler alert: What protection from that do you have now?

Do you have a lot of investment choices in your 401(k) plan and don’t know which ones to pick?

With Rita℠ not only can you quickly see which mutual funds are best for you, you’ll see how much more you could have made had you held those better choices. Rita℠ can also help you suggest better investment choices to be offered in your plan.

Prevent conflicts of interest from steering you into poor performing funds.

Ever worry that conflicts of interest may be negatively affecting the recommendations you’ve been getting? Rita℠’s patented decision-assistance technology effectively filters out all conflicts of interest, ensuring that you’re seeing the mutual funds and ETF’s that are objectively best for you.

While investing involves Risks and past performance is no guarantee of future results, regular use of Rita℠ enables you to answer this key performance monitoring question:

“How did my choice do versus all of the other choices I could have selected?”

If your mutual funds or ETFs start to drop in rank, you’ll now get to see which ones are moving up – all within the same asset class, the same goals and ranking criteria (yours), and same market conditions – something no investor has ever gotten to see. This can help you avoid one of the chief causes of chronic under-performance: holding poor performing choices far too long.

How Rita℠ Empowers You!

Easy to Use

Rita℠ is a web-based scoring and ranking application which provides you a search bar to easily enter in your choice of mutual fund or ETF ticker symbols, names, or asset classes, on any device, wherever you are connected to the internet.

Immediate Results

Initial results within Rita℠ display the top 10 highest scoring mutual funds and ETFs (you can see up to 50) along with your choice in the asset class and the class benchmark, based upon initial default settings.

24 Core Performance Factors

Initial results within Rita℠ display a score and a ranking derived from an initial blend of 6 weighted performance factors 1, 3, and 5-year average annual returns and 1, 3, and 5-year average annual volatility (risk). You can choose from 24 total performance factors and individually weight them in order of importance to you.

Choose Your Own Performance Factors

The Rita℠ performance factor menu allows you to choose which performance factors you wish to use in scoring and ranking the available choices and then lets you select the percentage weight of each of those factors based on our personal preferences and investment objectives.

Composite Scoring

Rita℠ generates a composite score for each mutual fund, ETF, and the Benchmark of the asset class based on the weighted performance factors you’ve chosen and is then used to rank all the available funds in the asset class, including yours, with the highest composite score ranking first.

The Final Results

Rita℠ displays the mutual fund or ETF you entered in the resulting table, displaying its numeric rank based on its composite score along with the top scoring funds and the benchmark for the asset class. And it will have all been done your way!

Insights

Learn More About Rita℠

Deloitte's AI Investment Prediction Misses Key Insight

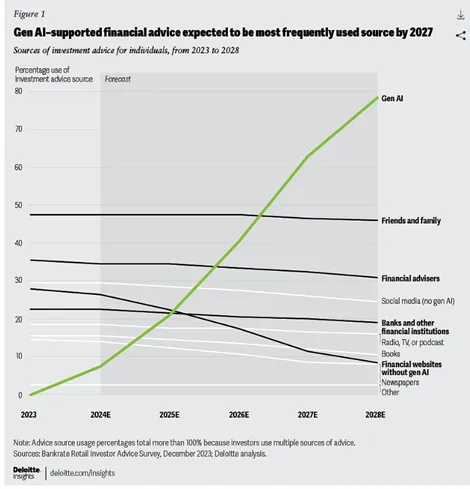

Deloitte has just released its Financial services industry predictions | Deloitte Insights. As shown in the diagram below, they predict a growing dependence on AI for investment advice.

But, if that proves to be true, who is that really going to help? Is it likely to meaningfully improve your investment results or your experience? We don’t think it will.

As we earlier wrote in Is there any difference between an “AI” and a Human Investment Advisor? (sayrita.com), we believe that AI, in its predicted role, will likely perpetuate a deeper dependence on “black box” / “behind the curtain” formulated recommendations and “advice,” the soundness and validity of which investors and/or advisors will have no way of verifying.

Will that improve investment results for individual investors? Who knows. But the experience of individual investors (you) – having to trust in investment advice formulated in a way that you cannot observe, directly influence (much less control), or verify for yourself – will likely not meaningfully change. Will “advice” from AI result in a meaningfully different experience for individual investors (you) from the advice you receive from a human advisor? As explained in our earlier post mentioned above, it likely won’t.

Unlike what Deloitte predicts is coming, there is a different way that AI can used other than simply assisting advisors in formulating their recommendations, or AI itself formulating investment recommendations . . . an application that Deloitte appears to have missed.

Our planned AI integrations with the already patented decision-assistance technology powering our Retail Investment Tracking ApplicationSM (“RitaSM”), for individual investors, focuses on enhancing investor empowerment. Those integrations are designed to enhance your power to directly control the comparative evaluation of mutual fund and ETF investment choices and your ability to identify and “vet” those whose composite investment performance (the blends of risk, return and other factors, you select and weight) have proven best over time at producing the investment results you’re seeking. Broad patents applications on these AI-powered enhancements were filed over a year ago.

But you need not wait for all of these enhancements, RitaSM is available for you to use today to optimize your investment selections.

Our goal is to transfer the balance of power away from the big financial service providers in that vendor-dominated marketplace and into the hands of individual investors (your hand) where we believe it as always belonged.

Interestingly, Deloitte also predicts that friends and family will continue to be preferred choices for individual investment advice, significantly beyond investment advisors. This may likely be due to the fact many investors don’t have sufficient investible assets to secure the help of an investment advisor. RitaSM could also play a big part in this, since it uniquely facilitates friends and family discussions and comparisons of the investment performance of mutual funds and ETFs.

Whether or not Deloitte’s predictions prove to be accurate, change is coming, and we are working to be at the leading edge of that change and, most importantly, the leading edge of empowering you and other individual investors.

Subscribe

Gain access to the power of Rita℠

No Credit Card Required To Start with Rita℠ Checkup!

Rita℠ Checkup

Free

No Credit

Card Required

Partial Rita℠ Features & Functions

Check How Your Current Choices Rank

Anonymous Ranked Funds

Email Support

Knowledge Base Access

Non-Commercial Use Only for a Single User

No Credit Card Required

Rita℠ Annual

Subscription

55¢/day

Billed Every

Year at $199

Full Rita℠ Features & Functions

Compare Your Choices Immediately

All Ranked Funds are

NamedEmail Support

Phone Support

Knowledge Base Access and Training Webinars

12 Month Recurring Subscription

Non-Commercial Use Only for a Single User

Rita℠ Monthly

Subscription

97¢/day

Billed Every

Month at $29

Full Rita℠ Features & Functions

Compare Your Choices Immediately

All Named Ranked Funds

Email Support

Phone Support

Knowledge Base Access and Training Webinars

Monthly Recurring Subscription

Non-Commercial Use Only for a Single User

spend a Day

with Rita℠

$7.97/day

Billed One

Time at $7.97

Full Rita℠ Features & Functions

Compare Your Choices Immediately

All Named Ranked Funds

Email Support

Phone Support

Knowledge Base Access and Training Webinars

One Day

Subscription

Non-Commercial Use Only for a Single User

Why Rita℠?

Worried about picking the right mutual funds and ETFs for your investment portfolio or your IRA or 401(k)? Rita℠ is the solution. Rita℠ is the only Retail Investment Tracking Application℠ that quickly and easily answers this key question: "Of all the available choices of mutual funds and ETFs, which ones are best for me? With Rita℠, you can feel confident that you're picking the best mutual fund and choices for your future. Stop guessing what's best for you - let Rita℠ do all the hard work!

“I've witnessed first-hand dozens of demonstrations of "RITA" to friends I’ve introduced. What's remarkable is when a person sees how much money he or she has not gotten over multiple years, they’re shocked. It shows them how much better they could be doing with this revolutionary investment tool.”

Robert S.

“This technology a game changer for individual investors. . . a major breakthrough. Investors will now be able to see how much money they’re leaving on the table, and the information obtained from Rita is actionable.”

Albert M.

Any investing-related information provided on sayrita.com is for educational purposes only. Decision Technologies Corporation does not offer investment advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular mutual funds, ETFs, or other investments.

<a rel="me" href="https://mastodon.social/@sayrita">Mastodon</a>

© Copyright 2025. Rita℠ by Decision Technologies Corporation. All rights reserved